Cloud hyperscalers including AWS, Microsoft, Google and Oracle spent nearly $1 billion per day in Q2 2025 on AI infrastructure to meet unprecedented demand, signaling a long-term transformative shift toward AI-powered enterprise.

Amazon

Satya Nadella broke tradition in Microsoft’s Q4 call, directly comparing Microsoft’s AI and cloud capabilities to AWS, Google, and Oracle, citing unmatched scale, speed, and infrastructure capacity.

The Cloud Wars Top 10 have surged past a $10 trillion market cap, reflecting unprecedented business confidence in the AI- and cloud-powered future.

Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

With CEOs leading the charge, AI is redefining how businesses function across all sectors, and Oracle’s market surge is just the beginning of a seismic economic shift.

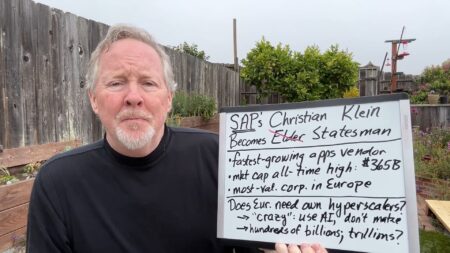

SAP is now Europe’s most valuable company, and CEO Christian Klein is leveraging that position to influence broader policy.

Once doubted, Oracle’s cloud strategy pays off big as it reports a 41% RPO surge and forecasts FY26 cloud growth over 40%, led by relentless AI infrastructure demand.

Oracle Cloud Infrastructure revenue surged 62% in Q4, showcasing significant demand growth and validating Oracle’s position as a hyperscaler.

Oracle’s blowout RPO numbers hint at massive contract-to-revenue transitions.