Analysts grilled Jassy on AWS’s relative underperformance — and the numbers don’t lie: rivals are catching up fast.

Cloud Revenue

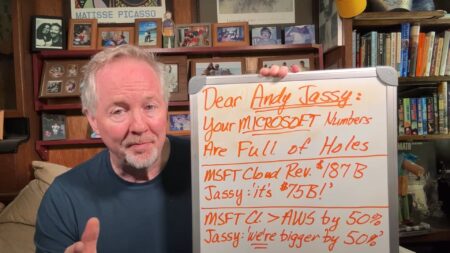

Despite strong revenue growth, AWS’s positioning in its latest earnings call drew scrutiny, especially when comparing its performance to Microsoft and other hyperscalers, whose cloud businesses are accelerating more rapidly.

AWS’s strong Q2 results falter when compared to the accelerated AI-driven growth of Microsoft, Google Cloud, and Oracle.

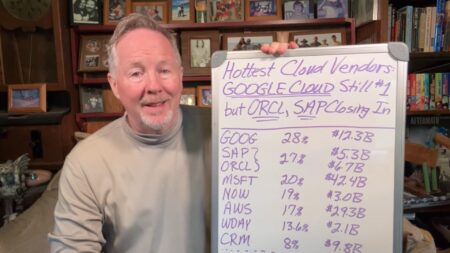

Google Cloud’s explosive Q2 growth in revenue, backlog, and AI momentum positions it as a serious contender to challenge Microsoft’s long-standing dominance in the Cloud Wars.

Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

The latest Cloud Wars update reveals strong growth across major cloud providers, with shifting dynamics that signal an increasingly competitive and evolving market.

Once doubted, Oracle’s cloud strategy pays off big as it reports a 41% RPO surge and forecasts FY26 cloud growth over 40%, led by relentless AI infrastructure demand.

Oracle’s blowout RPO numbers hint at massive contract-to-revenue transitions.

Despite Microsoft’s dominance in current cloud revenue, Oracle’s 63% RPO growth signals a potential reshaping of the Cloud Wars power dynamic.

With cloud revenue rivaling AWS and Google Cloud combined, Microsoft silences talk of an AI slowdown.

SAP dominates the enterprise cloud race in Q1, outperforming rivals with rapid growth in cloud and ERP revenue.