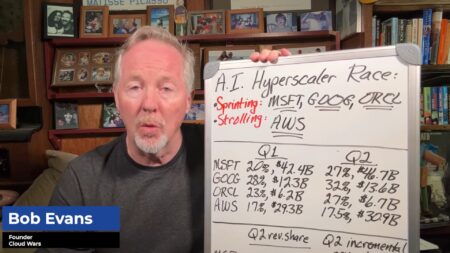

Even with $90 billion in Q2 CapEx spending, the major hyperscalers say cloud and AI demand will exceed supply until at least late 2025.

Oracle

Cloud hyperscalers including AWS, Microsoft, Google and Oracle spent nearly $1 billion per day in Q2 2025 on AI infrastructure to meet unprecedented demand, signaling a long-term transformative shift toward AI-powered enterprise.

Oracle and Google Cloud have partnered to deliver Gemini AI models via OCI, accelerating enterprise adoption of generative AI with seamless access and flexible billing.

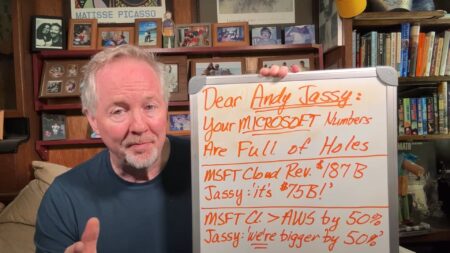

Analysts grilled Jassy on AWS’s relative underperformance — and the numbers don’t lie: rivals are catching up fast.

Despite strong revenue growth, AWS’s positioning in its latest earnings call drew scrutiny, especially when comparing its performance to Microsoft and other hyperscalers, whose cloud businesses are accelerating more rapidly.

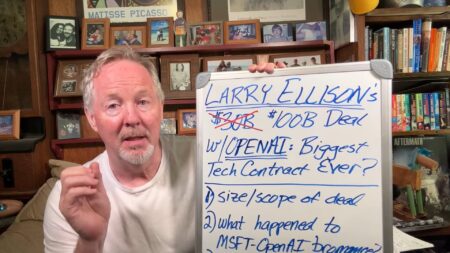

OpenAI will pay Oracle over $82 million daily starting FY28, cementing the largest tech partnership ever and signaling a major realignment away from Microsoft.

The AI Revolution accelerates as OpenAI selects Oracle over Microsoft for a $100B cloud deal, fueling speculation about the future of AI infrastructure and competitive positioning in the Cloud Wars Top 10.

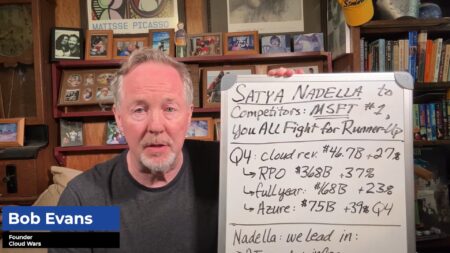

Satya Nadella broke tradition in Microsoft’s Q4 call, directly comparing Microsoft’s AI and cloud capabilities to AWS, Google, and Oracle, citing unmatched scale, speed, and infrastructure capacity.

Satya Nadella touts Microsoft’s Q4 cloud dominance, declaring MSFT #1 and challenging Google, Oracle, and AWS to compete for second place.

AWS’s strong Q2 results falter when compared to the accelerated AI-driven growth of Microsoft, Google Cloud, and Oracle.

Microsoft, Google Cloud, and Oracle are accelerating cloud growth and capturing more AI-driven business, while AWS lags behind in both pace and market share gains.

The Stargate project, now over 5GW strong, gains speed with Oracle’s massive cloud infrastructure build.

Microsoft just delivered the greatest quarterly financial results in the history of business — period.

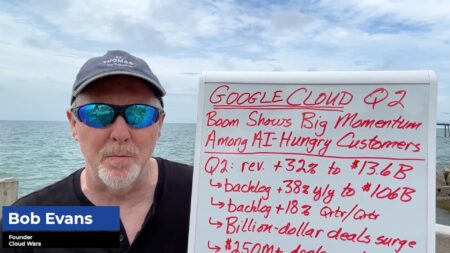

Google Cloud’s AI-native infrastructure and enterprise partnerships are fueling its fastest growth rate in years.

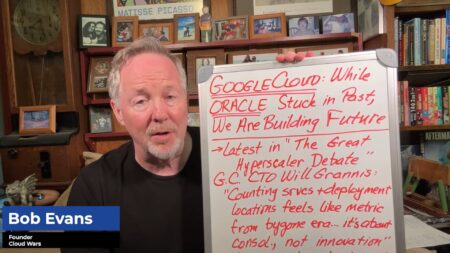

Oracle emphasizes breadth of services, while Google Cloud focuses on future-ready, data-centric platforms.

Oracle reignites the Cloud Wars with bold claims on unmatched AI deployment flexibility, prompting rivals to redefine what cloud leadership really means.

Oracle claims unmatched cloud capabilities—Google Cloud pushes back in a major way. The hyperscaler debate heats up as customers seek clarity on what really matters.

In under a year, AWS and NVIDIA co-engineered a hybrid liquid-air cooling system, showcasing the speed and depth of tech collaboration in the AI era.

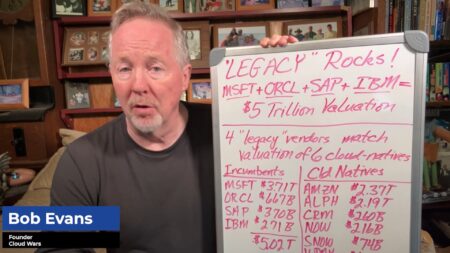

Veteran tech giants prove resilience and innovation still win, matching the market power of cloud-native disruptors.

Despite their age, legacy companies like Microsoft, Oracle, SAP, and IBM match the market value of newer cloud-native leaders, proving the power of incumbency in the cloud and AI era.