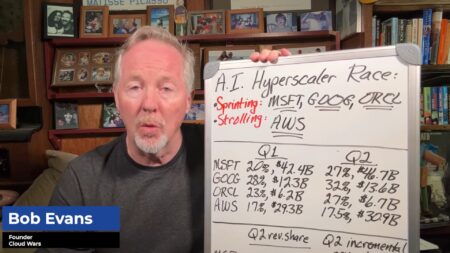

AWS’s strong Q2 results falter when compared to the accelerated AI-driven growth of Microsoft, Google Cloud, and Oracle.

revenue

Microsoft, Google Cloud, and Oracle are accelerating cloud growth and capturing more AI-driven business, while AWS lags behind in both pace and market share gains.

Microsoft just delivered the greatest quarterly financial results in the history of business — period.

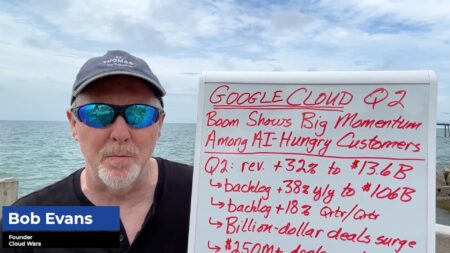

Google Cloud’s explosive Q2 growth in revenue, backlog, and AI momentum positions it as a serious contender to challenge Microsoft’s long-standing dominance in the Cloud Wars.

Google Cloud’s AI-native infrastructure and enterprise partnerships are fueling its fastest growth rate in years.

Microsoft’s 15,000 layoffs are a strategic move to retool for an AI-driven future, not just cost-cutting.

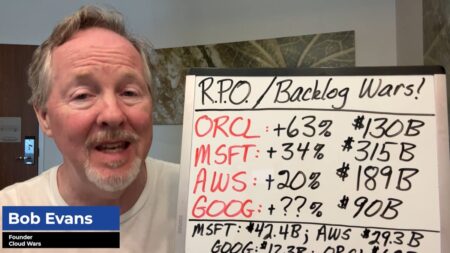

The Cloud Wars Top 10 have secured $915B in contracted future business, signaling extraordinary long-term demand for cloud and AI services.

Microsoft and ServiceNow collaborate to advance AI-powered agent-to-agent communication.

Oracle’s blowout RPO numbers hint at massive contract-to-revenue transitions.

Despite Microsoft’s dominance in current cloud revenue, Oracle’s 63% RPO growth signals a potential reshaping of the Cloud Wars power dynamic.

Oracle, Microsoft, AWS, and Google reveal surprising shifts in cloud leadership through RPO and backlog growth figures.

Microsoft’s blowout Q3 results and $315B in future cloud business crush AI slowdown fears and expose the absurdity of recent data center panic.

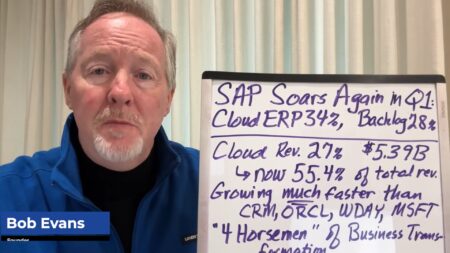

SAP dominates the enterprise cloud race in Q1, outperforming rivals with rapid growth in cloud and ERP revenue.

SAP delivered a standout Q1 performance, with cloud revenue surging 27% and its Cloud ERP suite up 34%, solidifying its lead over enterprise-app rivals.